Ocean Freight Performance in March 2021

March 2021 - Transportation Market Report

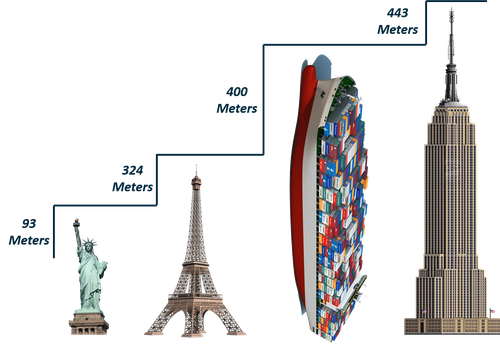

Infrastructure and Vessel Size, lessons learned from Suez Canal

When you look at the order book on what types of vessels people are investing in to build, it is the 10,000 to 20,000 TEU vessels. The Ever Given is a 20,000 TEU vessel. Based on the data vessels that size are going to be the new normal. Therefore, terminals are going to need to figure out a way to unload that stuff faster and continue to improve on productivity. That is going to come with a lot of data, analytics, and automation. When you say that word to the ILW, it is not necessarily a positive thing, because as you automate that could potentially reduce a job that a person was doing.

Additionally, if you have spent time in Southern California and you look at the port, there is nothing left in terms of the infrastructure and the available land. Where do you put these things? How are you going to reconfigure your terminal operations to accommodate much bigger ships, add more ship to shore cranes? How do you do all that in a finite footprint? It is not an easy thing to do. While it is wonderful news that Secretary of Transportation Pete Buttigieg is pledging to ease the port congestion and help exporters, there will not be any immediate relief.

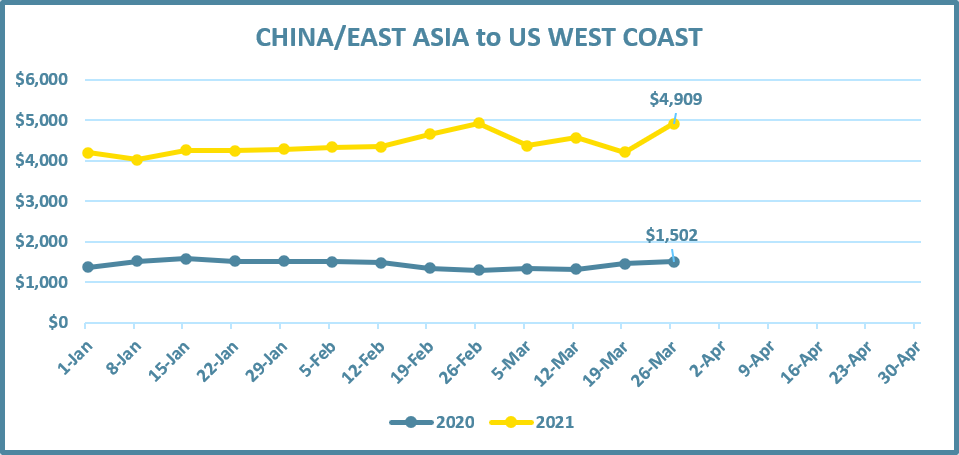

East Asia to West Coast Performance

On-time performance for carriers is at an all-time low. Once the vessel gets into birth, you are seeing delays on getting contained as discharged. That is still due to rudder reduce workforces on the shoreside operations. And then even getting it from an ocean terminal to a warehouse is taking time. These premiums, congestion issues, elevated cargo rolls, and overall delays are not going anywhere anytime soon. Try to utilize alternate ports of discharge (although East Coast vessels are booked to capacity). Diversify your carrier base to improve the likelihood of even obtaining space. BCO’s are negotiating contracts for 2021-2022. The previous USWC CY rate of $1200-$1300 is most likely a thing of the past. Top volume importers will still fair better than most but plan on 25%-40% increases in your new ocean budgets. Ensure you understand your BAF clauses in your contracts as global fuel costs continue to rise.

Other ports

Vessel utilization on East Coast service strings is running near max capacity. Major ports such as Savannah, Charleston, Norfolk, and NY/NJ are all reporting significant increases in congestion. Plan on significant increases in your Asia-US East Coast base port pricing. Ensure you understand your BAF clauses in your contracts as global fuel costs continue to rise. For shipments going to Europe (as well as the US), companies will need to buffer freight budgets and transit times. Explore sea-air options through Dubai or Malaysia. Contact your forwarders about possible rail opportunities from China to Europe. Capacity is tight everywhere but explore all options.

Key takeaways

If you are a shipper previously operating in the spot market, work with your forwarders and carriers to secure negotiated pricing-even if it is for shorter increments. Ensure you understand your BAF clauses in your contracts as global fuel costs continue to rise.

Click the Button above to receive the full transportation market report for March 2021.