Freight Market Indicators in December 2021

December 2021 - Transportation Market Report

Manufacturing Purchasing Managers Index (PMI)

- Economic activity in the manufacturing sector grew again in December. This is the 19th consecutive month of expansionary growth.

- Demand and consumption still are exhibiting month-over-month growth, in spite of continuing obstacles. Meeting demand remains a challenge, due to hiring difficulties and a clear cycle of labor turnover at all tiers.

- New Orders Index registered at 60.4% which is down 1.1% compared to November, Production Index was 59.2% (down 2.3%), Backlog of Orders increased to 62.8% (up .9%), and New Export Orders registered 53.6% (down .4%). Customers Inventories remain in the ‘too low’ category. All of these are positive indicators for continued growth, but also indicate further capacity issues in the transportation markets.

Key Takeaway:

While the manufacturing sector continues to stay in a demand-driven, supply chain-constrained environment, there are some bright spots. We are seeing indicators of improvement in labor resources and supplier delivery performance. Coronavirus will continue to play a major factor as the virus surges have led to worker absenteeism, short-term shutdowns and other related issues.

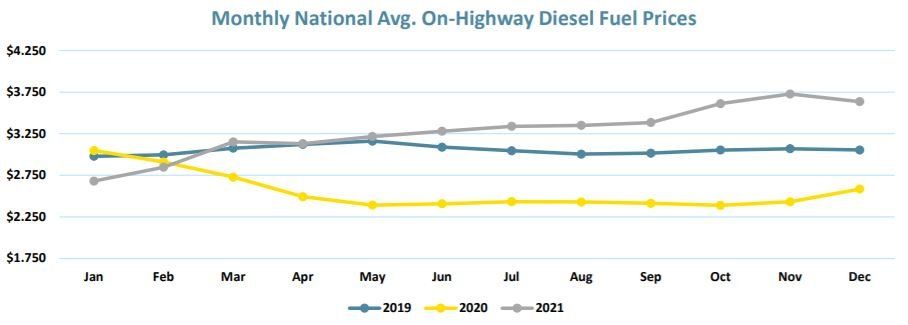

On-Highway Diesel Fuel Updates

- More than 110 million Americans traveled for the holidays, up 30 million from last year.

- On-highway diesel fuel prices dropped 10¢ from the start of the month. While prices remain high, we are still optimistic that costs will soften.

Key Takeaway:

Barring nothing changing, we continue to expect to see diesel fuel costs drop through the new year. The oil supply increasing combined with COVID outbreaks will create more supply than demand, thus lowering prices.

Click the Button above to receive the full transportation market for December 2021.