Market Update - Week of August 17, 2020

- Imports. Import volumes began to climb in June, with strong volumes in July. August, so far, has also been strong. This is related to a few things:

- PPE. PPE production remains strong with no real drop off in sight.

- Home gym equipment, outdoor furniture, etc. orders continue to increase

- We are moving into the traditional peak season for ocean freight as retailers ramp up for holidays.

- Although mall traffic is essentially non-existent, consumer spending continues to grow in the online space.

- Essential verticals (food/bev/pharma/etc.) continue to see strong order volumes.

- PMI (Purchasing Manager’s Index) has risen in 3 consecutive months and hit 54.2 in July. This is a general outlook for manufacturing, and anything above 50 indicates expansion and growth.

Ocean/Air:

In terms of cost, the ocean freight market continues its historic climb. Capacity is increasing, but that’s because the volumes are there to support it. Two weeks ago, the spot rate for a container from Asia to the US West Coast was around $2800. Today, it’s slightly over $3000, which is a 7% increase. To put that in perspective, one year ago the costs were about $1,425; which is roughly up 110% year over year. The carriers are also looking to push another GRI through in August, and if they are successful, this may not be the peak.

Two weeks ago, the Asia to US East Coast rates were around $3350. Currently, they are at $3500, which is about a 30% increase from what the rate was last year ($2,700). The North Europe to US East Coast rates remain stable; essentially flat to last year, which was around $1750-$1775.

Terminal operations remain challenging on the West Coast, and every terminal right now is publishing on their website that they are short on chassis and truckers should bring their own.

Air freight remains incredibly challenging. Rates have only moderately softened and buy capacity remains extremely tight. Apple, Samsung, and Sony all have major product launches coming in the next few weeks, so this will compound an already tight market. We predict that rates will exceed what we have seen already this year.

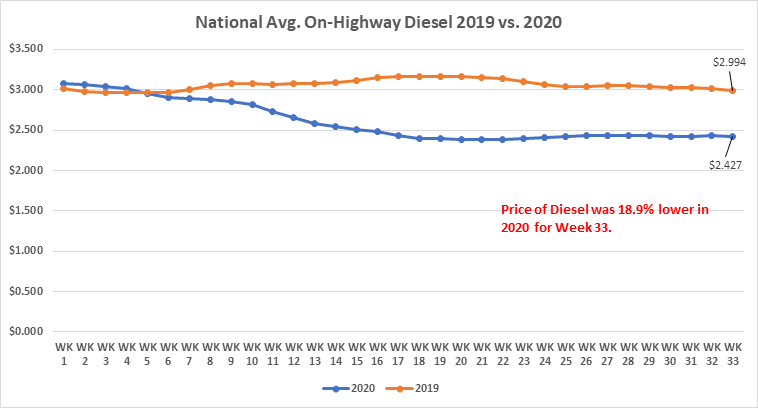

Fuel

Fuel remains consistent with virtually no change in the National Average pricing of On-Highway diesel. This week it’s $2.427, which is down $0.001 from last week, and up $0.003 from two weeks ago. Below is a year on year comparison of the first 33 weeks of 2019 and 2020.

The biggest challenge we face is predicting what is going to happen next. We are closely monitoring the market, so if you have questions or want to jump on a call with us, we would be more than happy to get in touch with you.