Expert Research, What Happened with IMO 2020 Fuel Prices?

An update on how things are developing with IMO 2020/VLSFO.

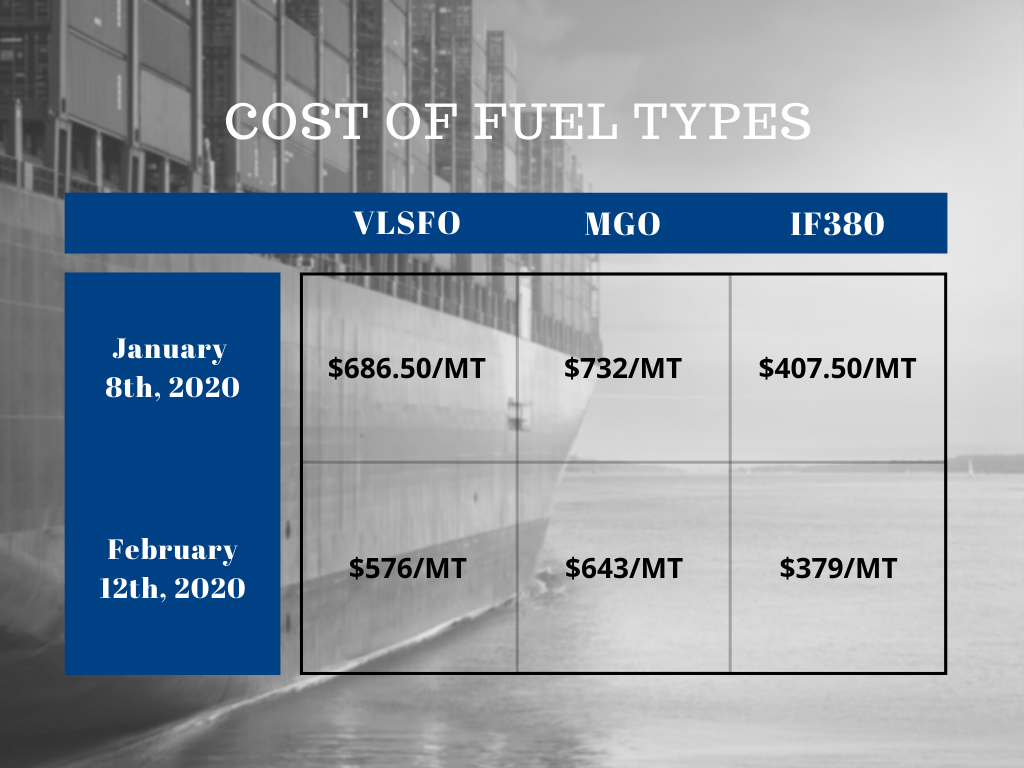

The IF380 is the high Sulphur fuel type that carriers were using previously. To put things in perspective, a container vessel can hold anywhere from 1.5-4.5M gallons of fuel depending on the size of the vessel. The amount of fuel used is dependent on the speed of the ship. The smaller Panamax ships (~5,000 TEU capacity) will consume ~63,000 gallons of marine fuel per day when operating between 20-25 knots. Fuel consumption can drop by almost a third when ship speeds are reduced by 10% (called slow-steaming). So you can see the importance of the decision to install scrubbers with a higher upfront investment but lower on-going costs or no investment and higher/unknown fuel costs. As of today, the highest VLSFO costs I see are in Houston, TX at $526/MT. IF380 in Houston, TX is at $375/MT.

The biggest issue shippers are having is that each carrier seems to have its methodology on how bunker is being calculated and charged to the BCO. Previously, the bunker would be tied to an index that could be tracked and was fully transparent. In today’s state, that transparency does not exist (or rarely exists), and it makes it very difficult for Transportation Operators to budget costs for 2020. We strongly encourage everyone to have direct conversations with carriers to understand their bunker calculation methodology and also be clear on if your bunker surcharge will be fixed for a certain amount of time or will float with the market.

Here in the U.S., there is a residual effect of Lunar New Year and Coronavirus. As factories have struggled to ramp back up (or even open up), obviously the volume of imports to the US is down significantly-especially into California. Many companies are revising revenue projections due to the on-going issues in China (Apple, Adidas, etc.) Given this drop in volume, we’ve seen some carriers increase rates for loads going into California as they are not confident they will be able to secure a load coming out of California. There is also some concern about domestic rates potentially in the April/May timeframe. Meaning-if production in China begins to ramp back up to “normal” capacity, there could/should be a spike in volume in April/May. This in itself will stretch domestic capacity. May 15th also marks the beginning of produce season in California which typically stretches reefer capacity on its own. We’ll continue to watch this closely.

About the author:

Chris Peckham, Director of Operations,

prior to joining Aborn & Co., Chris was director of supply chain at SharkNinja where he was responsible for procurement, inventory management, and new product development. He has also worked as assistant vice president of transportation for the Ascena Retail Group, and as operations director for Adidas-Group Mexico.