Truckload Performance in May 2021

May 2021 - Transportation Market Report

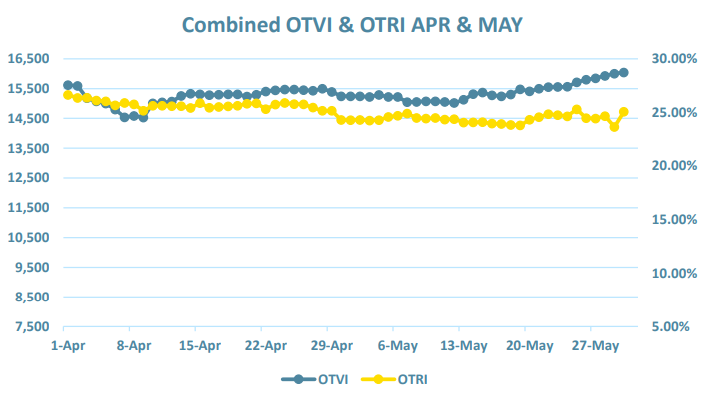

From a truckload standpoint, the data is similar to April, but the volume is elevated, with the volume index remaining above 14,000. As expected, there was a dip after Memorial Day. The rejection index is decreasing, remaining between the 23% and 25% range, not by much but it is still not a positive statistic. Anything under 20 is something to avoid.

What to Expect

There will be a dip in volume initially at the beginning of the month. However, volumes and capacity will quickly tighten. Inventories at shippers remain at all-time lows. Re-stocking will continue and companies will continue to pull in orders due to long delay times at ocean terminals.

Reefer capacity is going to remain tight, and costs will continue to rise through produce season. Dry Vans could plateau, but severe weather-related events like we’ve seen in the Southeast will create headwinds for capacity loosening and rates leveling or falling. Be diligent with order and tender lead times. Work with your customers on market conditions and initiate conversations around chargeback waivers.

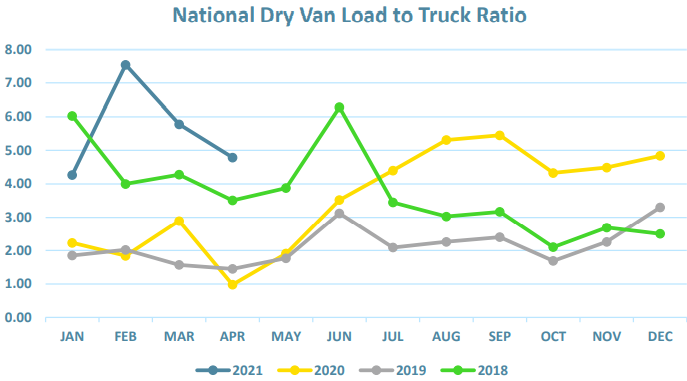

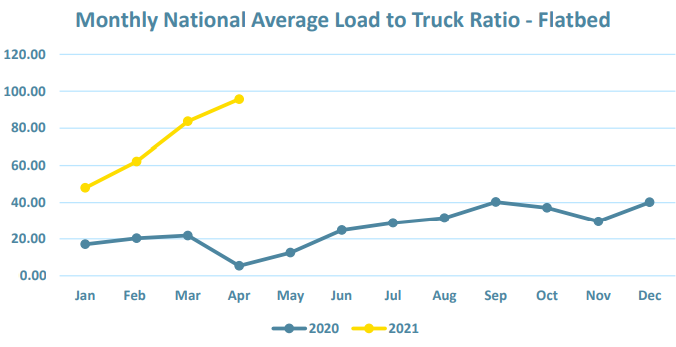

As we move into warmer weather, Flatbed utilization will continue to rise. The normal cost per mile runs similar to Reefer. However, the load to truck ratios are in a class of their own. April load to truck was 95.70 vs. 4.41 for Dry Vans and 9.02 for Reefers. We anticipate Flatbed costs and capacity to remain elevated and restricted for the coming months. Construction volumes should remain high (steel, lumber, equipment), the manufacturing and automotive sector continues to improve, and oil consumption continues to rise.

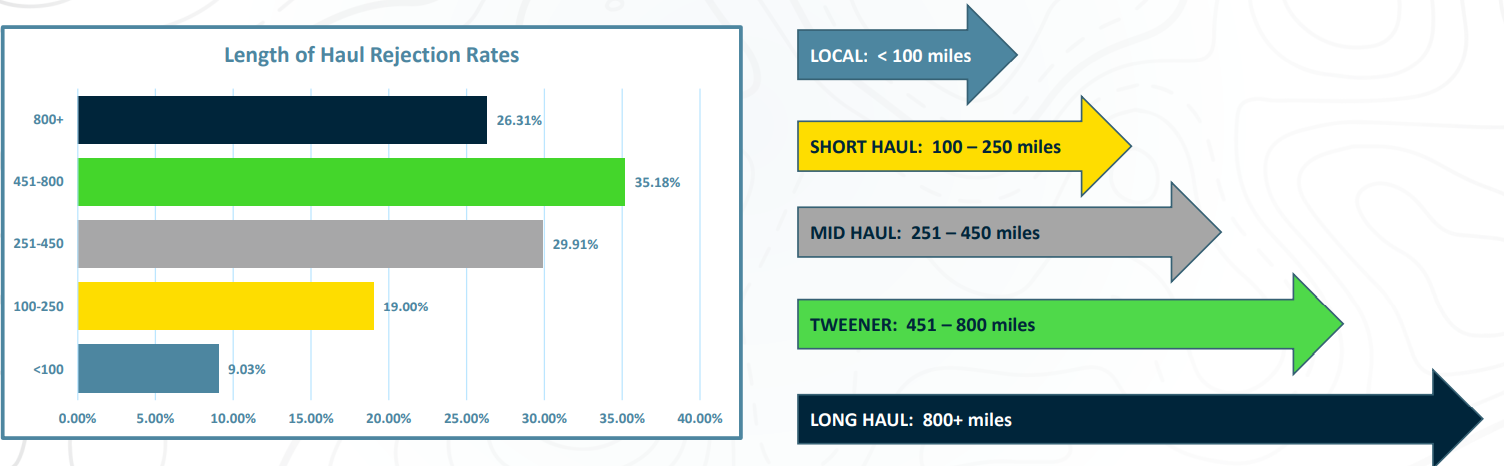

Length of Haul Rejections

This measures the Rejection rate compared to a specific length of haul. We’ve seen an increase in the Rejection Rates in four of the five groupings. Long Haul Rejection Rates have remained essentially flat. The “Tweener” lane continues to have the highest Rejection rate by category. Previously, drivers could make the 450+ mile runs in a day. Due to HOS regulations, they are no longer able to do so. Ensure you are providing more than adequate lead time, and ensure appointments are set at both the shipper and receiver.

Key Takeaways

Tender lead times are key. Each day a load isn’t covered prior to the ship date results in increased costs.

With Spring here, IMDL operations will be less susceptible to weather-related events and will be a cost-effective alternative in some lanes. However, due to high import volumes, non-contracted IMDL volume will be challenging alternative from a cost and capacity standpoint.

Click the button above to receive the full transportation market report for May 2021.