Truckload Performance in December 2021

What's new in the TL Space?

- The markets performed as they historically have in December:

- Volumes dropped right at Christmas time and remained low to the new year.

- Rejection rates rose slightly towards the end of the month. However, they were still 10% lower than this time in 2020.

- Although rates are not expected to significantly rise in Q1, we do not project any material reprieve in terms of reduced costs or improved capacity.

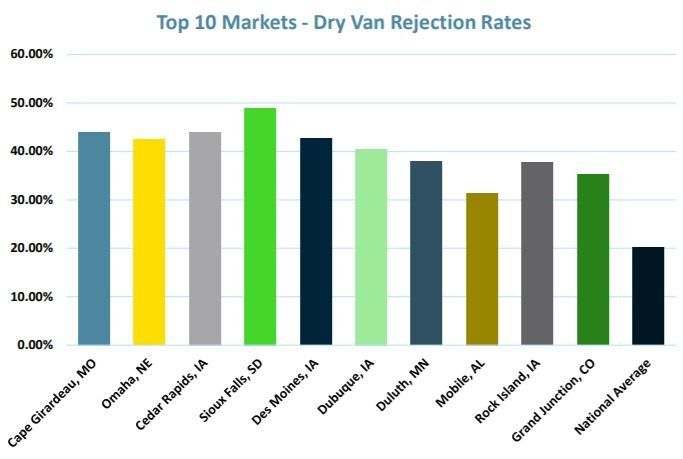

Dry Van: Load To Truck (LTT) & Cost Per Mile (CPM)

- December rates increased by $.08 compared to November.

- There’s no indication of relief in terms of volume for Q1 of 2022. Import volume projections will remain extremely high and domestic manufacturing is expected to remain strong.

- With import volumes remaining strong, we would expect capacity to remain tight and costs to continue to rise for OTR volumes near major import gateway locations.

Key Takeaway:

As usual, the month of December slowed as the weeks progressed. Capacity tightened as the holidays approached. We saw a decrease in volume leading into Christmas but capacity fell off at a similar pace as we saw the OTRI remain flat.

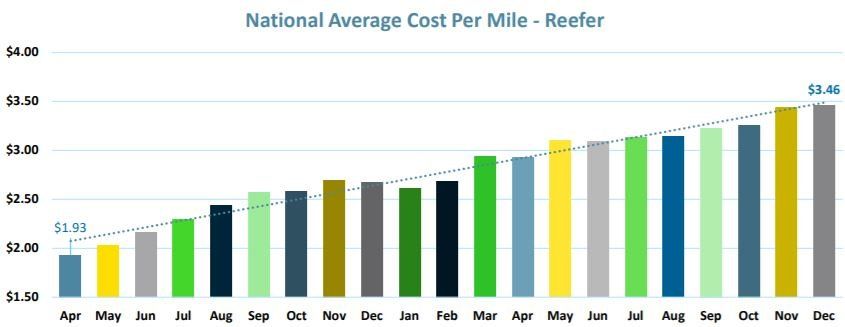

Reefer: LTT & CPM

- The reefer space remains extremely tight in terms of capacity with elevated rates.

- We do not expect rates or capacity to improve in Q1 of 2022.

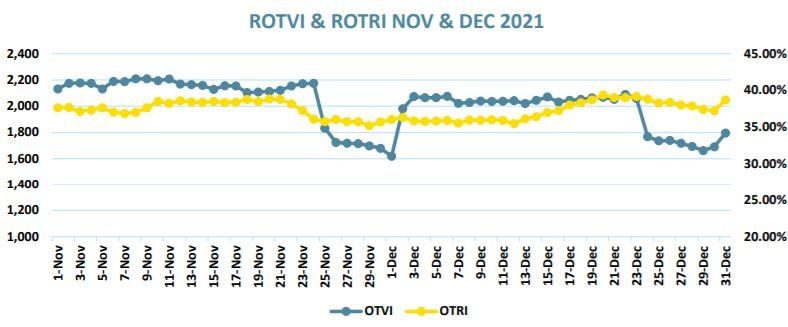

Reefer: Outbound Tender Volume (ROTVI) & Outbound Tender Rejection (ROTRI)

- The Reefer LTT remains significantly elevated vs. both 2020 and 2019. There’s no end in sight in terms of loosened capacity or a regression in rates.

- Volumes remain elevated and capacity remains tight. As expected, Rejection rates remained high despite a slight softening in overall volume. Drivers are headed home for the holidays and the capacity crunch will remain to start the year.

Key Takeaway:

Expect higher rejection levels in locations with serve winter weather. Carrier equipment shortages will play a huge factor in the upcoming months. We do not expect rates or capacity to improve to start 2022.

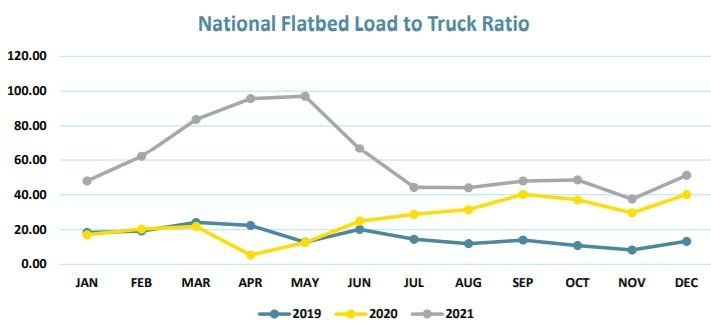

Flatbed: LTT, CPM and FOTRI

- Another mode affected by the holidays; we saw a spike in rejection near the end of the month as drivers headed home.

- We expect the rejection rate to recover in January, but flatbed utilization will continue to remain strong.

Key Takeaway:

We anticipate Flatbed costs and capacity to remain elevated and restricted for the coming months. Construction volumes should remain high (steel, lumber, equipment), the manufacturing sector continues to improve.

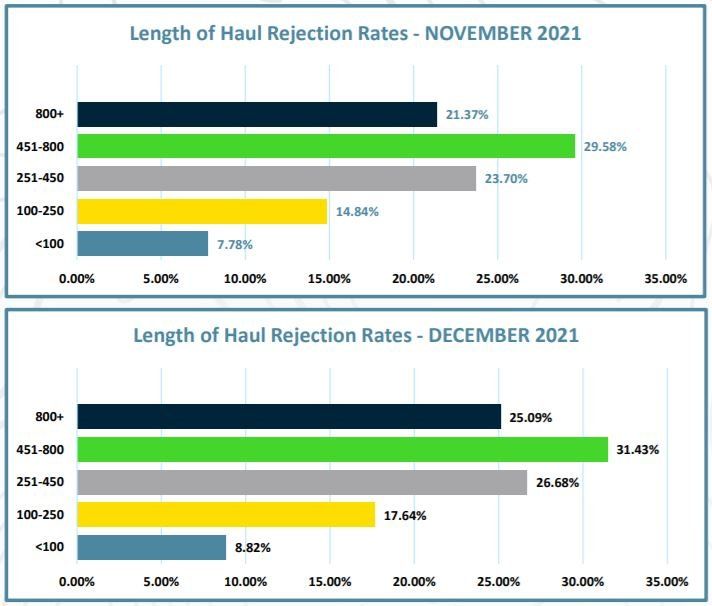

Domestic TL Length of Haul Rejections

This measures the Rejection rate at specific lengths of haul. We saw rates increase for all lengths of haul during the month.

Key Takeaway:

The “Tweener” lane continues to have the highest Rejection rate by category. Previously, drivers could make the 450+ mile runs in a day. Due to HOS regulations, they are no longer able to do so. Ensure you are providing more than adequate lead time, and ensure appointments are set at both the shipper and receiver.

Click the button above to receive the full transportation market report for December 2021.