Truckload Performance in August 2021

August 2021 - Transportation Market Report

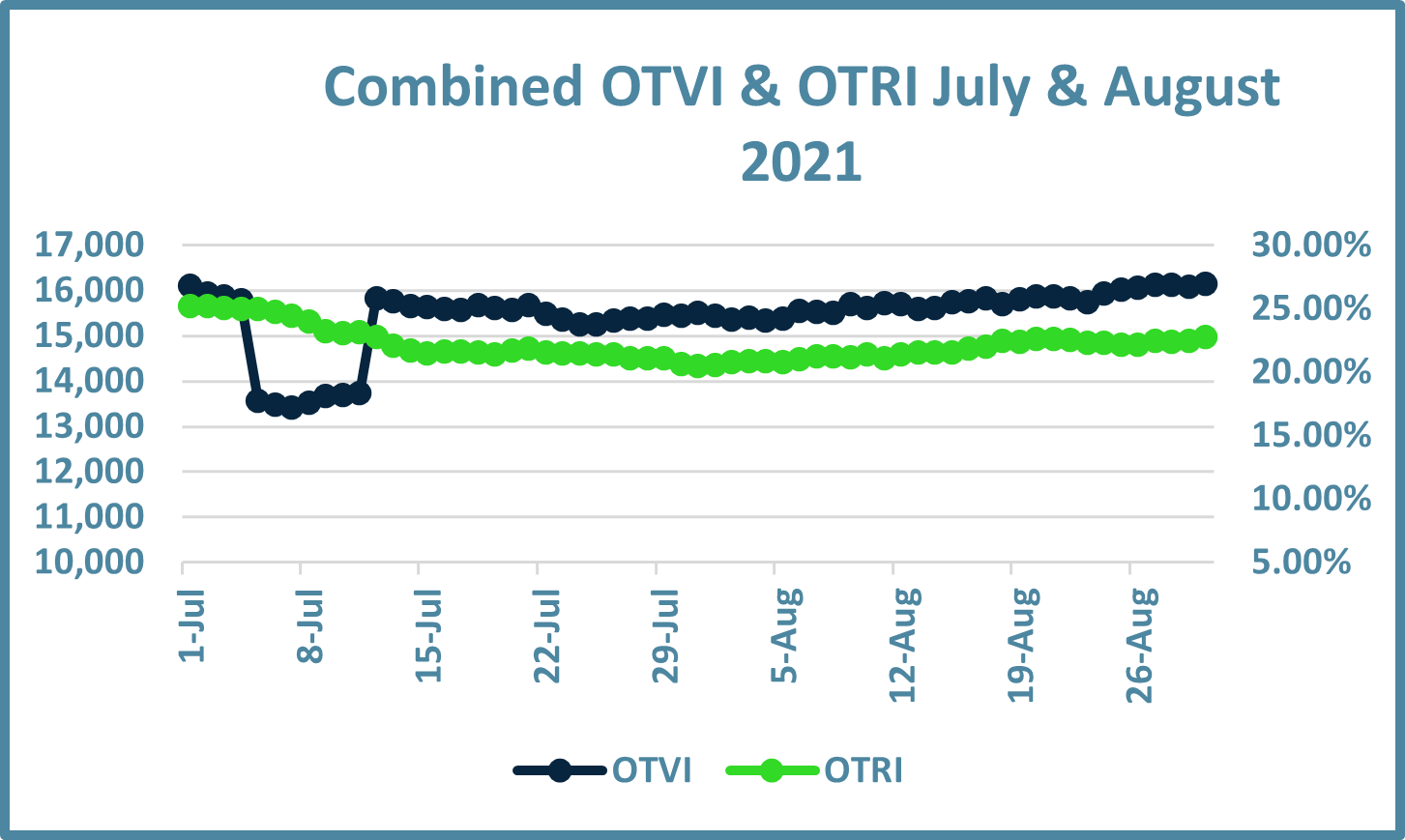

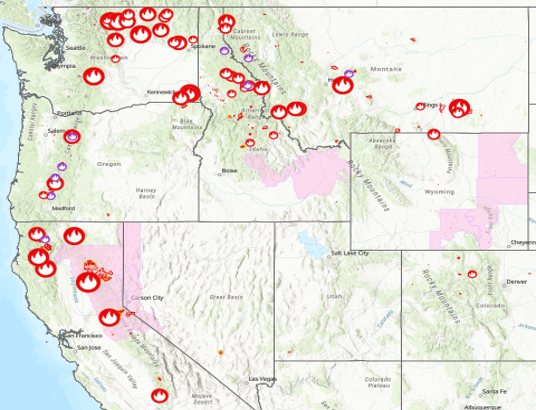

The TL market remains extremely elevated across almost all markets. Volumes surged again in August with the OTVI rising another 4.6%. We feel rates will remain elevated for the balance of 2021 and most likely H1 2022. Wildfires continue in the West and Hurricane Ida will impact rates and capacity across the U.S. as carriers move FEMA loads to support the region.

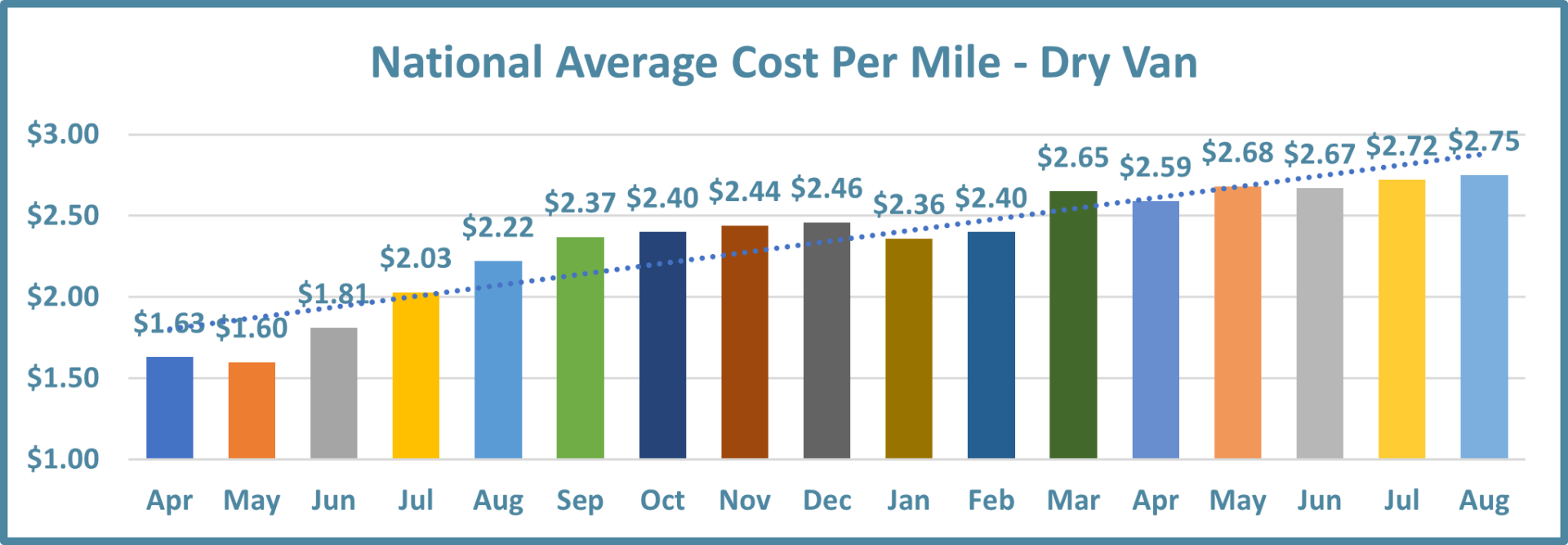

Dry Van: LTT & CPM

There’s no indication of a let up in terms of volume for the balance of 2021. Import volume projects will remain extremely high and domestic manufacturing is expected to remain strong.

The NorCal/PNW remains an extreme challenge due to wildfires. Securing capacity will be a challenge for both IB/OB in this region. The Southeast has been hit with Hurricane Ida which will negatively impact rates and capacity throughout the U.S.

Volumes are not expected to drop through 2021, and most likely at least Q1 2022. Communicate internally and reasonably work with your carrier base. Hurricane Ida will have a significant impact on rates and service across all of the U.S.

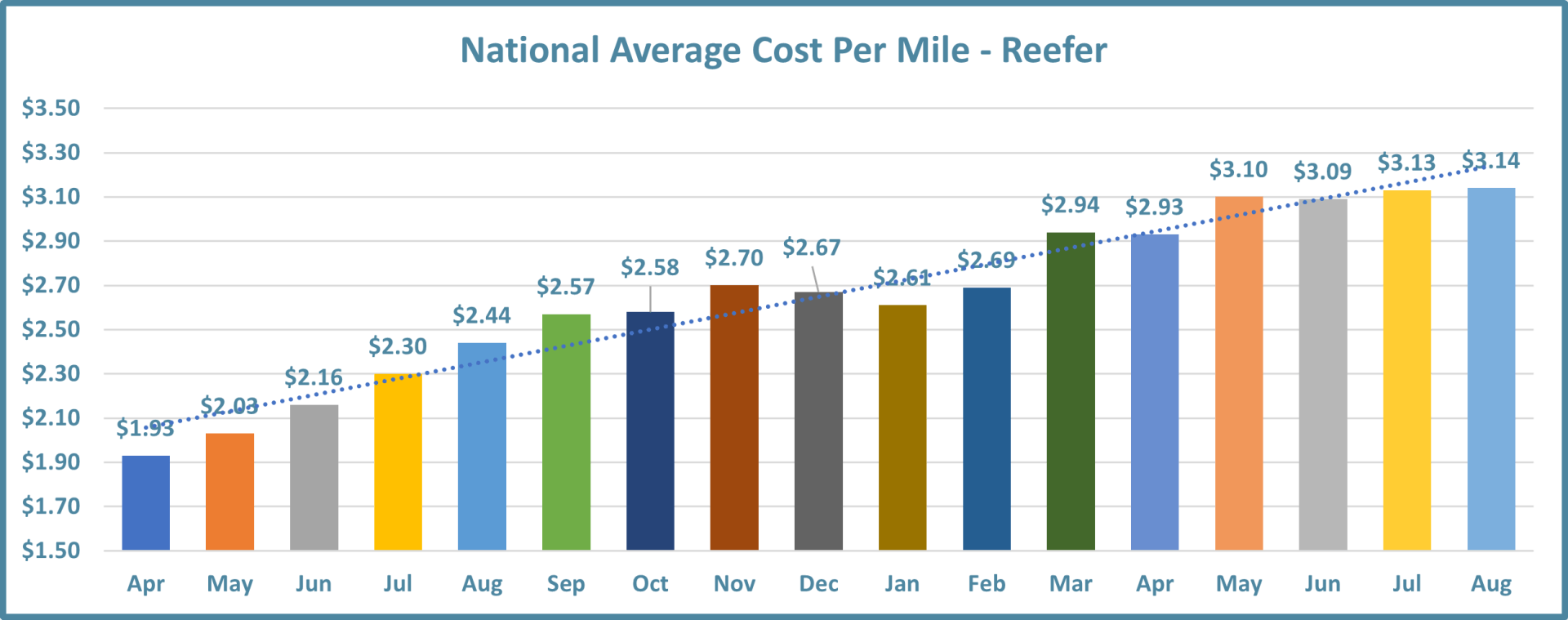

Reefer: LTT & CPM

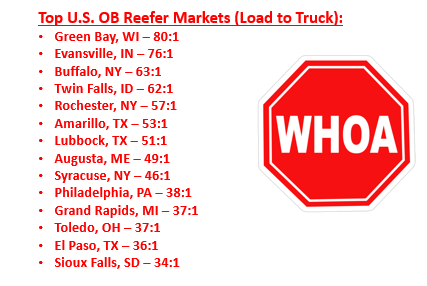

The reefer market surged in August with the LTT ratio rising 40% from 11.62 to 16.31. Rates continue to climb and both the Volume Index and Rejection Index climbed by 12.5% and ~6 percentage points, respectively. We aren’t expecting any significant relief in terms of reefer capacity in the month of September. Stay proactive with your carriers, and ensure load tenders are issued as far in advance as possible.

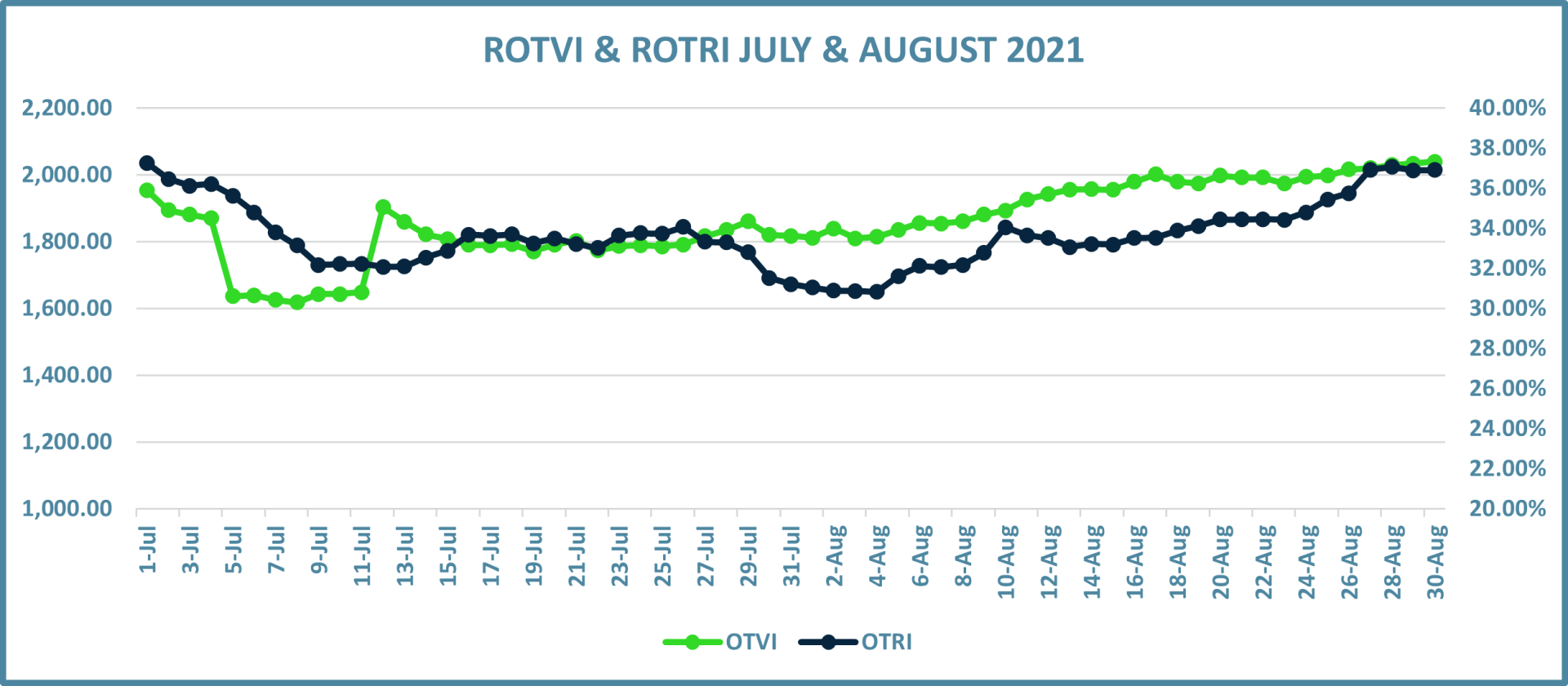

Reefer OTVI & OTRI

Reefer Volumes and Rejections rallied from a slight regression in July and early August. Wildfires in NorCal continue to burn and Hurricane Ida will have a material impact in terms of rates and capacity, further straining and already struggling market. We aren’t expecting any significant relief in terms of reefer capacity in the month of September. Stay proactive with your carriers, and ensure load tenders are issued as far in advance as possible.

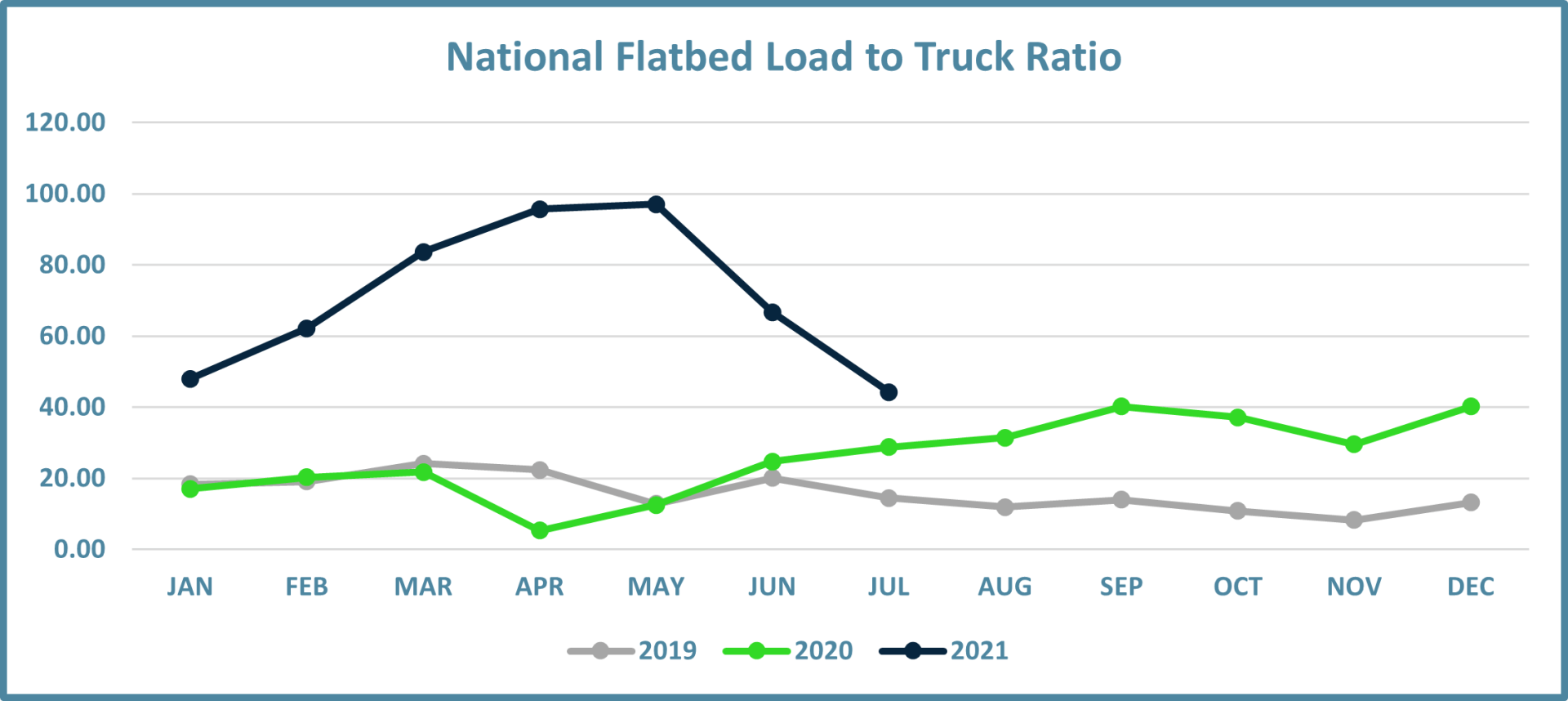

Flatbed: LTT & CPM

As we move into warmer weather, Flatbed utilization will continue to rise. Although new construction builds dropped in April, they came back in May, and rose again in June. New construction builds for June 2021 are up 42% vs. June 2020. Although the Load to Truck Ratio dropped in June, it still remains 2.5X what it reported in June 2020. It takes about 5 flatbed loads of lumber to produce 1 new home. 1.57M new homes were built in H1 of 2021.

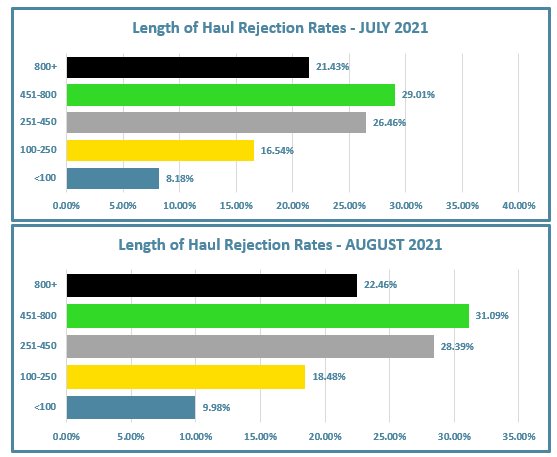

Domestic TL Length of Haul Rejections

This measures the Rejection rate compared to a specific length of haul. Month on month we have seen slight increases in all mileage categories. The “Tweener” lane continues to have the highest Rejection rate by category. Previously, drivers could make the 450+ mile runs in a day. Due to HOS regulations, they are no longer able to do so. Ensure you are providing more than adequate lead time, and ensure appointments are set at both the shipper and receiver.

Click the button above to receive the full transportation market report for August 2021.