Ocean Freight Performance in May 2021

May 2021 - Transportation Market Report

Congestion on the West Coast

• 52 vessels are at anchor or drifting. The ports include LA/LB (21), OAK (22), SEA/TAC (6), VAN (6)

• Severe global container shortage. Costs of producing a 20’ container have risen sharply ($1,800 early 2020, $2,500 late 2020, to currently $3,500).

• In Q1 of 2021, Hapag-Lloyd had an EBIT of $1.53B. That is the equivalent of all four quarters combined in 2020. Most carriers are recording record profits. They are also introducing a $3,000 GRI effective 6/15.

• One shipper had to pay $14,000 for a 40’ container shipping from China to the US West Coast. Another paid over $17,000 to get the same size container from Taiwan to New York.

Key Takeaways

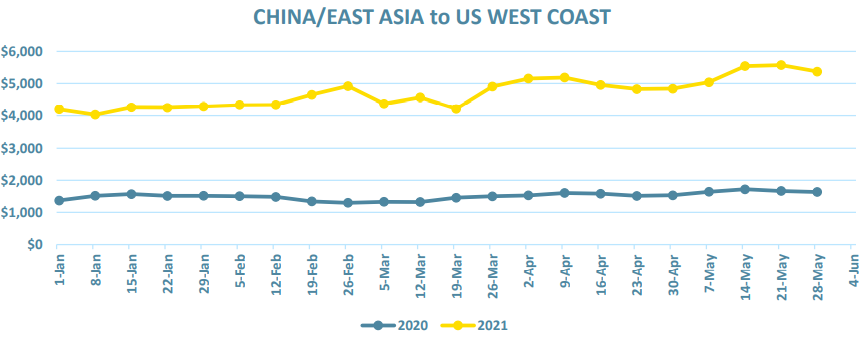

Congestion issues, elevated cargo rolls, severe equipment shortages and overall delays are not going anywhere anytime soon. Try to utilize alternate ports of discharge (although East Coast vessels are booked to capacity). Diversify your carrier base to improve the likelihood of even obtaining space. BCO’s are negotiating contracts for 2021-2022. The previous USWC CY rate of $1200-$1300 are a thing of the past. Top volume importers will still fair better than most, but plan on 40%-70% increases in your new ocean budgets. Ensure you understand your BAF clauses in your contracts as global fuel costs continue to rise.

Click the Button above to receive the full transportation market report for June 2021.