Ocean Freight Performance in July 2021

July 2021 - Transportation Market Report

Ocean Updates

• Typhoon In-Fa completely knocked out operations in Shanghai & Ningbo the weekend of 7/24. The residual impact is generally considered minimal.

• The Federal Maritime Commission is forming a National Shipper Advisory Council to begin to review and address the seemingly endless rise in costs and degradation in service.

• Biden Administration has issued an Executive Order encouraging competition across multiple sectors. The FMC and STB are investigating their respective industries for unfair practices related to detention and demurrage.

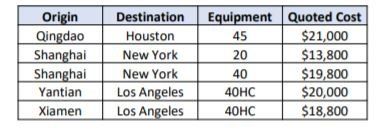

As previously noted, the index rates we track do not include premiums and surcharges. On the TPE trade, there are an additional $3k-$9k in additional charges associated with container movements.

• COVID breakout in Yantian (handled 13M TEU in 2019 for comparison POLA handled 9M TEU same year) created significant issues at origin resulting in over 50 vessels at anchor and a large amount of blank sailings where carriers did not call Yantian.

• Essentially every available vessel that is sea-worthy is being used by carriers. The orderbook for new vessels is extremely high.

• National Retail Federation (NRF) is projecting the back to school spend to hit $37B vs. $33.9B in 2020. They also project the back to college spend to hit $71B vs. $67.7B in 2020.

Container Shortage? Just Build More…?

Factories are producing new containers at a record pace

• Containers today are already being produced at record levels in an attempt to meet demand.

• H1 2021 saw 2.6M TEU of dry (non-reefer) containers produced. That exceeds the 12-month output of most years.

• 2021 full year output could reach 4.5M TEU. 30% above the record set in 2018. • This would increase the global container equipment fleet by 8%.

The cost of container production has skyrocketed

•The cost per TEU in June of 2020 was ~$2000. It’s currently $3800!!!!

Production of new containers is dominated by China

• 80% of dry containers are built by 3 main Chinese factories:

• CIMC Group

• CXIC

• Dong Fang

• 96% of all dry containers are made in China.

• 100% of all refrigerated containers are made in China.

Why doesn’t the US product containers? Its simple economics

• The price of steel is about 60% of the cost to build a container.

• Currently, the price of hot-rolled coil steel in the U.S. is double what it is in China.

• Labor costs in the U.S. are significantly higher than in China.

• Much lower equipment repositioning costs by producing in China.

Click the Button above to receive the full transportation market report for July 2021.