Market Update - Week of September 7, 2020

TL/IMDL

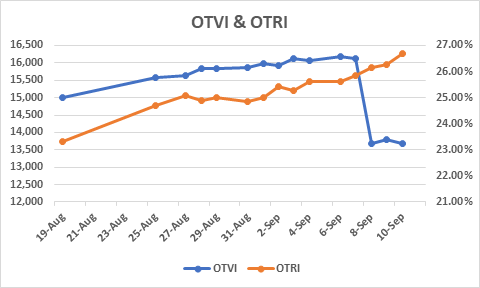

Capacity remains tight, although there was a significant drop in the OTVI from 9/7 to 9/8. It remains significantly elevated, as does the OTRI. Rejections and Volumes will remain high throughout the balance of the week as we finish off this week’s CVSA International Roadcheck. And although it is hard to believe, the holidays are right around the corner and retailers/e-tailers continue to restock goods. California remains particularly problematic with import volumes remaining strong and expected to remain strong as importers look to get their goods produced and shipped prior to the Golden Week Holiday (10/1-10/8). The wildfires are continuing, which is directly impacting available capacity.

The National Van Load-To-Truck Ratio continues its upward swing with another 1.6% rise from last week.

Not surprisingly, The National Average for Van Rates is also remaining elevated from levels in August. The CVSA Brake Inspection, Hurricane in the Gulf Region, increased import volumes and wildfires out West are all contributing to driving costs up. Van Spot Rates are up 4.3% week on week but over 22% year on year.

IMDL rates continue to climb as well. Back in May the National Average was $1.31/mile, so far in September it is $1.81, or a 38% increase in cost. Overall volumes continue to surge largely tied to the increase in international volume. IMC’s are also passing along surcharges that rail operators have put in place which penalizes excess volume to forecast. A $3500 surcharge per shipment was being applied to any volumes considered incremental.

Ocean Freight/Air Freight

The Ocean Freight market continues to set new records in terms of pricing. The spot rate from main base ports in China to the USWC is now $3700-that is up another 8% week on week and 146% year on year. Shipment costs from those same ports to the USEC are not fairing much better at $4482. That is up 9% week on week and 51% year on year. One small win remains North Europe to the USEC-rates are $1625 which is down 5% week on week and 12% year on year.

Air Freight is going to remain extremely tight for the balance of Q3 and most of Q4. Until we see that passenger capacity get reintroduced to the market, rates will remain extremely elevated. Capacity will take another significant hit once a vaccine is developed and needs to be distributed globally. There are estimates that to supply the proper amount of vaccines, it could take anywhere for 8,000-12,000 full cargo aircrafts (depending on which source you read). Either way, that is a massive number.