LTL Market Update with Chris Gula

Chris Gula, Senior Manager LTL, provides some context regarding the recent chaos in the LTL market.

The LTL market is in absolute disarray and I don’t think the issues are going away any time soon. I speak with carrier representatives every day and have built many relationships throughout the industry over the past 24 years. In speaking with a few of my contacts the past few weeks this is what I have heard from them.

- A dispatcher who I speak to regularly told me just this week that missing 50 pickups a day has become the norm.

- A separate dispatcher told me they had 30 people absent this week due to contact tracing after a positive Covid test.

- Most companies do some kind of “manpower planning” on a daily or at least weekly basis. Consider this scenario: you are managing one of those facilities and receive a phone call at 8 pm on Wednesday. One of your employees had gone home sick 2 days earlier and just called in to notify the company that he has tested positive for Covid. After the contact tracing is complete, you will now be short 30 employees (dockworkers, drivers, customer service representatives, management personnel, etc) until they either test negative or clear quarantine.

- Many have also told me they are “fencing” loads daily because they cannot keep up with volume.

For those of you unfamiliar with the term “fencing loads", this is when a carrier doesn’t unload all the inbound freight that arrives during the Inbound operation. This freight, per transit times, is scheduled to go out for delivery that day but it is stored in a trailer at the destination facility – missing published transit times. This term is also used when the Outbound shift cannot work through the freight picked up that day in the city operation (because outbound drivers still have to depart timely to keep the linehaul network in cycle), and the loads are being held at the facility. Again, this eliminates any chance of meeting published transit times. Cycle is what drives a carriers’ operational costs and ultimately their service. If the cycle is thrown out of whack for any reason, the whole network could get backlogged, immediately causing service failures and increased costs.

How will it affect all of you?

Possible rate increases, diminished service, longer transit times, increased damages (in my experience companies in this position try to hire too rapidly and train poorly to get fresh bodies into the operation), and a lot of frustration.

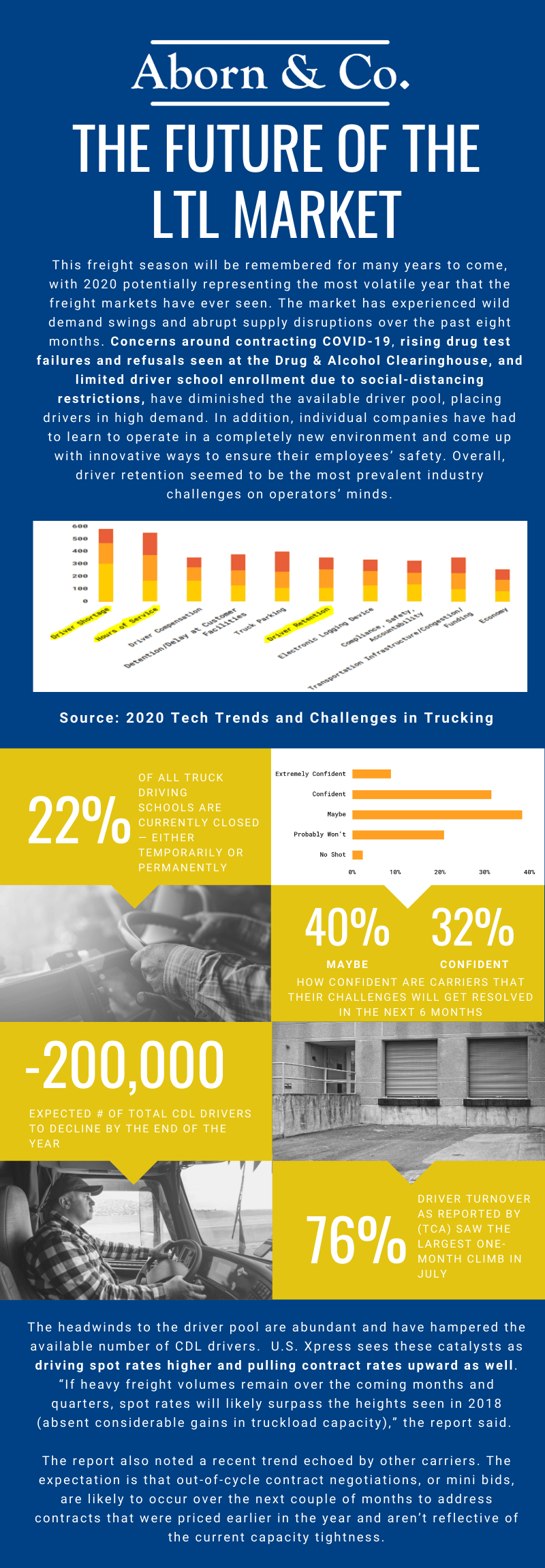

In order to assist in understanding why the market is experiencing such volatility , we have put together an infographic with the "experts" viewpoint. The material will shed some light on what we are looking at for the next several months. I know the initial reaction will be to switch carriers. My recommendation for everyone is to work even closer with Aborn and the incumbent carrier during this time. Every carrier is having the same issues and fighting the same battles. Switching carriers at this time should only be considered in very drastic situations. We are also going into winter and peak season which present their own obstacles.