Freight Market Indicators in September 2021

September 2021 - Transportation Market Report

SUMMARY

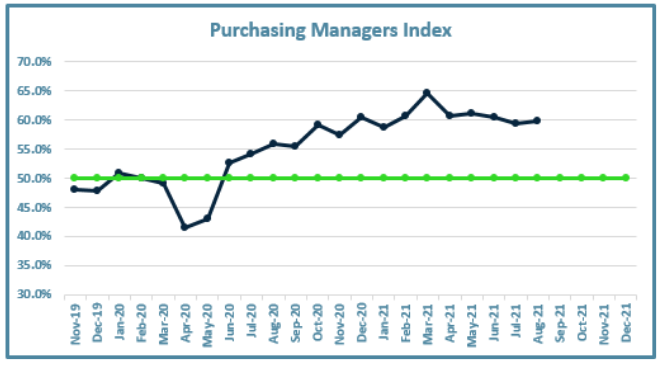

- Economic activity in the manufacturing sector grew again in August. This is the 15th consecutive month of expansionary growth.

- Record long raw material lead times, wide-scale shortages of critical materials, rising commodity prices and difficulties in transporting products all highlight August challenges.

- New Orders Index continues came in at 66.7% (up 1.8% since July), Production Index is at 60.0% (up 1.6% since July), Backlog of Orders increased to 68.2% (up 3.2% since July), and New Export Orders registered 56.6% (up 0.9% since July). Customers Inventories remain in the ‘too low’ category (30.2% - up 5% since July). All of these are positive indicators for continued growth, but also indicate further capacity issues in the transportation markets.

Key Takeaway

All signs point towards continued expansion in the manufacturing sector. Absenteeism, facility shutdowns due to material shortages, and general hiring difficulties are currently limiting maximum manufacturing growth potential. With on-going low inventories and increases in new orders, manufacturing output is projected to remain strong for the coming months.

On-Highway Diesel Fuel Updates

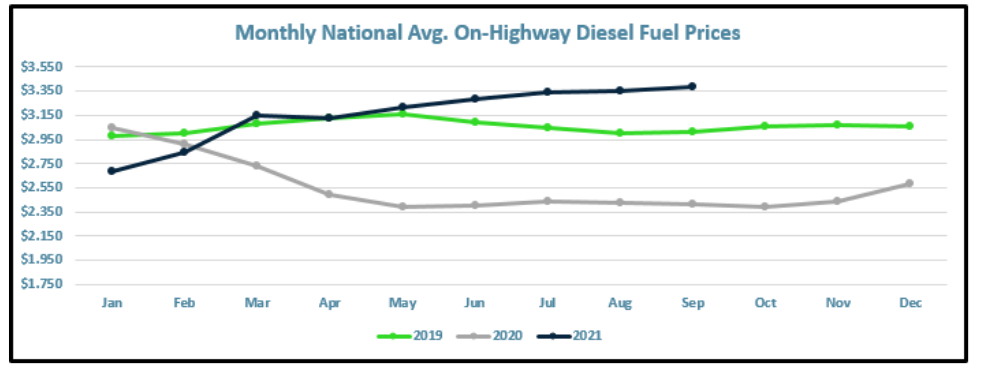

As expected, the price of fuel has risen with Hurricane Ida contributing to that increase.

EIA still projecting 2021 diesel to average $3.17. They are projecting 2022 to average $3.08.

The UK driver shortage is estimated at 100k drivers. There are critical shortages of petrol prompting the government to use military assistance to execute deliveries of petrol to retail locations.

Key Takeaway

Given the drop in domestic passenger travel, and the on-going Delta variant, we should see fuel prices soften somewhat in Q4.

Click the Button above to receive the full transportation market for September 2021.