Freight Market Indicators in June 2021

June 2021 - Transportation Market Report

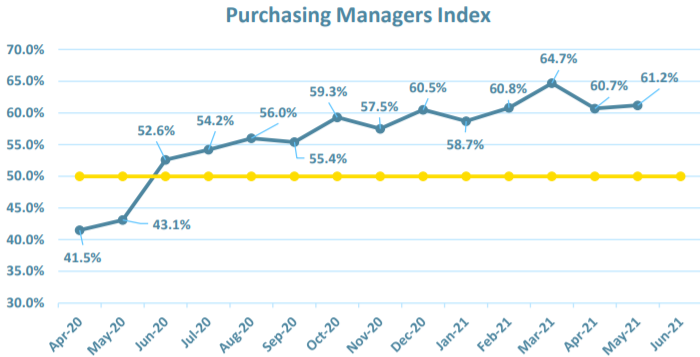

Manufacturing Purchasing Manager's Index (PMI)

• Economic activity in the manufacturing sector grew in May. This is the 12th consecutive month of expansionary growth.

• Long lead times, wide-scale shortages of critical materials, rising commodity prices and difficulties in transporting products all highlight May challenges.

• New Orders Index continues to rise (67%, up 2.7 percentage points since April), Production Index is down (58.5), Order Backlog rises again (70.6%, up 2.4 percentage points since April), and New Export Orders continues to improve (55.4%), Customers Inventories remain in the ‘too low’ category (28% - a new all-time low). All of these are positive indicators for continued growth.

Key Takeaways

All signs point towards continued expansion in the manufacturing sector. Absenteeism, facility shutdowns for sanitization, and general hiring difficulties are currently limiting maximum manufacturing growth potential. With on-going low inventories, increases in new orders, and manufacturing output is projected to remain strong for the coming months.

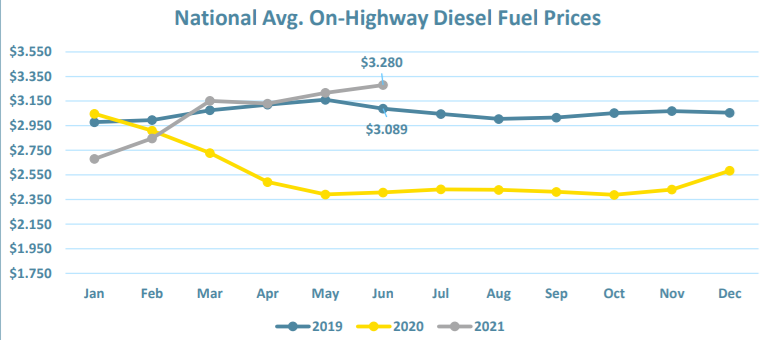

On-Highway Diesel Fuel Updates

• On-Highway Diesel monthly average is up 22.3% since January and up 39.4% on a per week basis from 11/2/2020.

• EIA projection for 2021 has increased to $3.04/gallon which is up from the previous projection of $2.94/gallon.

Key Takeaways

In May, the price of diesel is more in line, but exceeding 2019 levels by 6.1%. As more and more Covid restrictions are lifted, we expect consumption to continue to rise. Airline travel is increasing, and ocean freight bunker consumption will remain extremely strong

Click the Button above to receive the full transportation market for June 2021.