Compliance Science: How Incoterms Work

Who here can't get their head around Incoterms ? The most important part of every import and export invoice can also be the most baffling for many shippers, buyers, and sellers. What is it about these three-letter abbreviations that leave so many of us scratching our collective heads? What exactly are Incoterms, what do they mean to you, and how can you use them to your advantage?

International Commercial Terms ('Incoterms') are internationally recognized standard trade terms used in sales contracts. They're used to make sure buyer and seller know:

- Who is responsible for the cost of transporting the goods, including insurance, taxes and duties

- Where the goods should be picked up from and transported to

- Who is responsible for the goods at each step during transportation

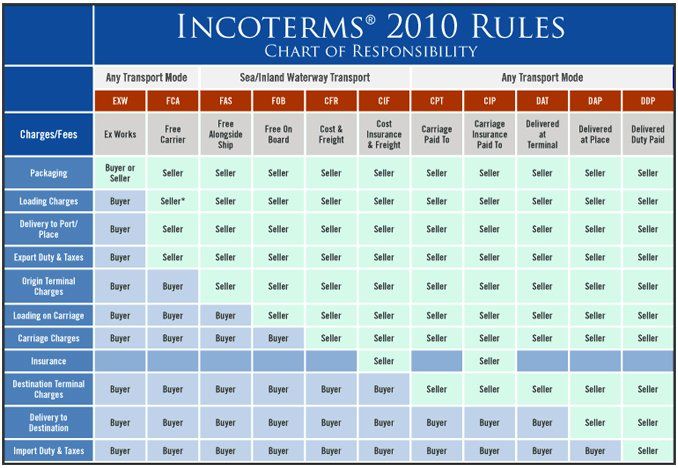

While there are 11 Incoterms, an easier way to think about them is look at them as 4 groups separated by the first letter of their abbreviation. You'll see why below.

E – Departure

( EXW)

F – Main Carriage Unpaid (FCA, FAS, FOB)

C – Main Carriage Paid

( CFR, CIF, CPT, CIP)

D – Arrival

( DAT, DAP, DDP)

E Group - E is for Easy. The easiest of all for the seller. This simply means that they are selling you the goods at invoice value with no added transportation or insurance costs. You sell them, pack them, and make them available at your warehouse/factory then the buyer handles the rest. While this is the least involved term for the seller, it is the most involved for the buyer as the buyer now has to arrange everything else. In addition, the buyer assumes all risks involved as soon as the goods are pick-ed up.

F Group – F is for Free. Not of cost, unfortunately, but free (cleared) to export. Here's where the buyer and the seller both begin taking responsibility for the move. On an F term, the seller would arrange inland transportation and bring the goods to the port/terminal of the buyer's choosing and clear them for export through customs. The buyer would be responsible for paying for any ocean/air freight, customs, duties, & terminal fees at the port of arrival, as well as any additional transportation costs associated in getting these goods to their final destination.

C Group – C is for Carriage aka freight. If you're buying on a C term your seller is not just bringing the goods from their warehouse to the port of export, they're also paying for the overseas shipping to your named port/terminal of arrival. Once at the port, the buyer then clears customs, pays all terminal charges, and arranges delivery to the goods final destination. In a term like CIP, the I stands for insurance. Beware of getting your insurance through the seller as they are not obligated to select an all-risk policy leaving you with more exposure than you'd assumed.

D Group – D is for delivered. Here the seller must pay for all costs associated with getting the goods to the port/terminal of arrival. The first thing that separates the C's from the D's is that in the C terms, the buyer assumes ownership/risk of the freight once it arrives at the carrier. With a D term, risk/ownership isn't transferred until the ship arrives at the port/terminal of arrival. D terms are also the only ones that can include both delivery to the goods' final destination as well as import customs & duties charges.

Here's what it all looks like laid out:

You may be thinking, DDP looks great! I pay one price, assume no risk, and the goods will show up free of any additional obligations. While this is true, here could be the problem with a term like DDP: every one of those steps along the way is a transaction. Each one of those transactions will be added to your cost of purchasing. While you may pay one price, that price is derived from the cost of all of these transactions behind it plus any profit the seller may add.

This can significantly increase your cost of goods in a number of ways. If your seller has poor rate contracts, adds a surcharge, or both, that could end up rolled into your invoice cost.

In addition, you're allowing the seller to select all of your carriers along the way. Once you've paid them, their interest now shifts to getting the best rates for themselves. This could mean using less reliable carriers, slower services, and ultimately, delays in receiving your cargo. In addition, you'd be relying on a foreign entity to handle customs in a country they may not be familiar with.

Maybe there is some risk involved after all.

Got it! So EXW is the way to go? Not so fast. The problem with a term like EXW is that now you're responsible for a lot of groundwork in a country where you may not have the proper relationships in place to handle those logistics. Dealing with foreign truckers and export customs can be a nightmare for many buyers.

So what's a discering buyer to do? Fortunately, there are 9 other Incoterms. Many buyers find FOB to be just right. With FOB you don't have to worry about dealing with overseas customs or truckers, but you can still pick you carriers, negotiate your own freight costs, use a local broker who knows customs at the port of arrival, and have your goods delivered to your warehouse by your preferred truckers.

If you're a buyer and you use E or F terms, you control your freight volume. Significant freight volume can be used to leverage rates, create consolidations, and build routes.

The same logic applies if you're a seller. Shipping can be turned into a profit center as costs can be added at the time of sale increasing margins and giving your business a competitive advantage.

What term you use depends on your situation. The most import thing is to buy and sell on the correct one and as The Rock says, "Know your Role!"

If you have a robust import/export program you likely would want to buy (import) EXW-FOB and sell (export) DAT-DDP

If you're buying or selling a couple containers a year and don't have the resources to handle the logistics it could be to your advantage to do the reverse. Buy DAT-DDP and sell EXW-FOB as you simply don't have the volume to create leverage nor the staff to cover the workload.

Knowing your invoice Incoterms is knowing your asset's cost. Knowing your asset's cost is knowing your asset's value!

Still unsure about which Incoterm to use and when? Think you may be using the wrong ones at the wrong time? We can help. Contact Aborn & Co. today for a free consultation !

Listen to this article on the latest episode of Consulting Logistics below or subscribe now on iTunes , Spotify , or simply search your favorite podcast player for Consulting Logistics!